Micro, Small, and Medium Enterprises (MSMEs) are vital to India's GDP. They employ more than 110 million people, but they face many problems when they start and expand their businesses.

That is why to help MSMEs, the Government of India created new classification criteria for MSMEs, and based on the new classification, all MSMEs in India are called Udyam. Registration of MSMEs, known as Udyam Registration, has been made mandatory for every MSME.

Let us understand Udyam Registration, its benefits, and how to generate a Udyam Registration Certificate through Register Udyam in this article.

Process of Udyam registration

The Government of India has started Udyam Registration in place of Udyog Aadhar. Registration is a paperless self-declaratory and user-friendly online process through which MSMEs can avail of various government benefits. The step-by-step process is given below through which you can register your organization online for Udyam Registration.

-

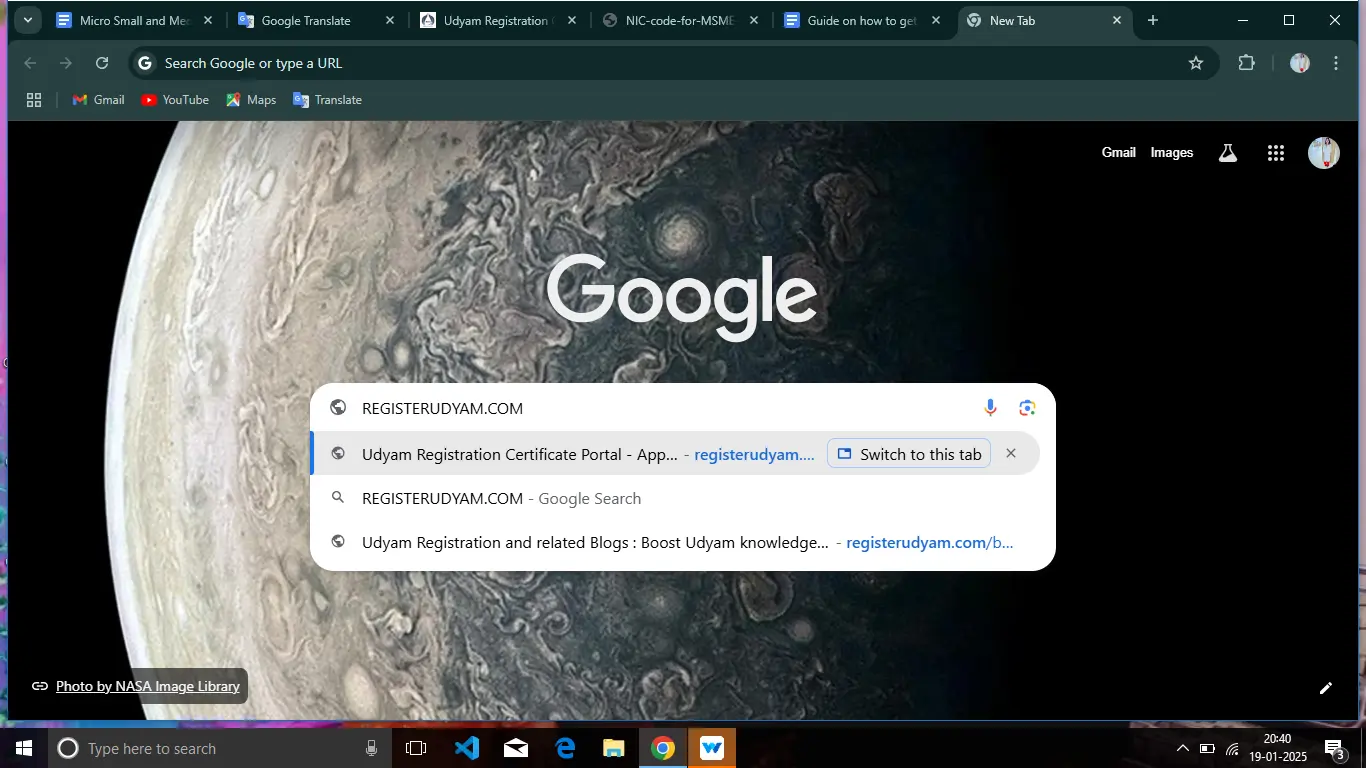

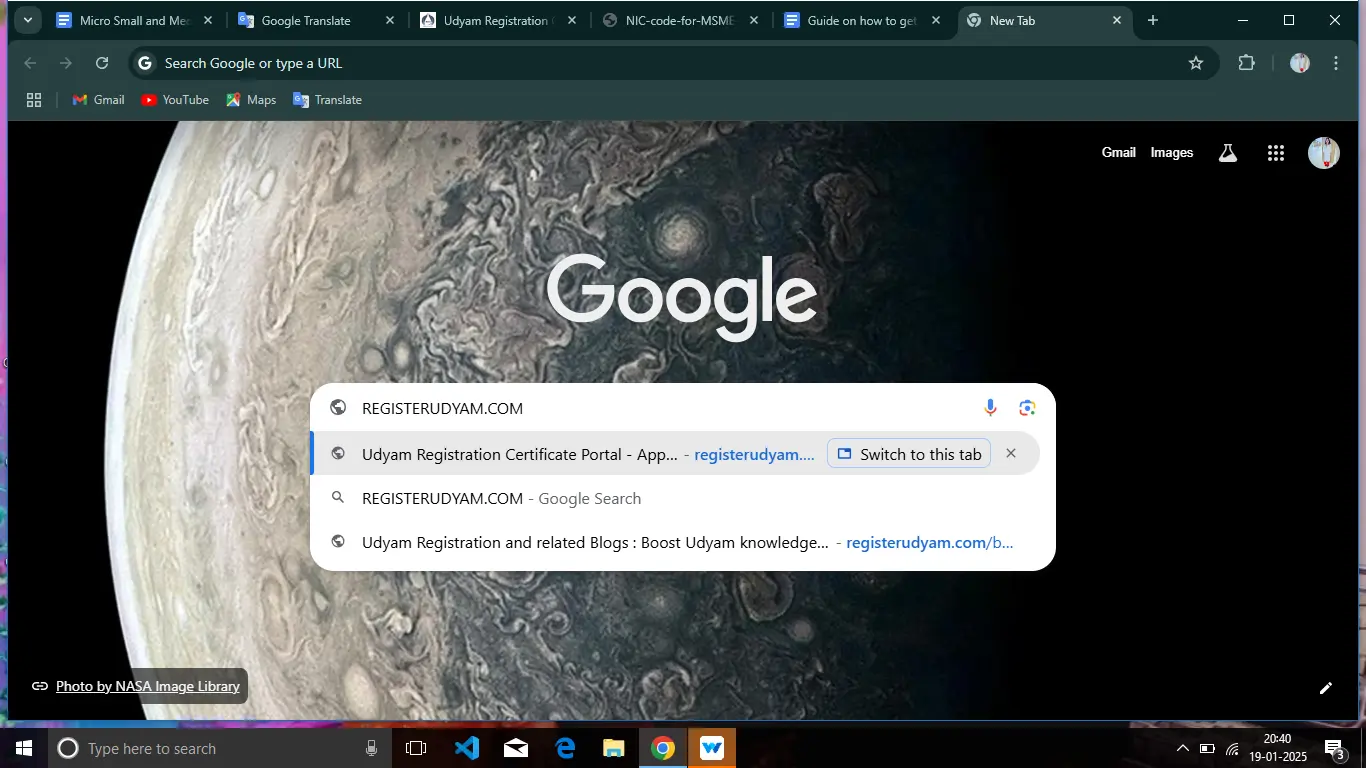

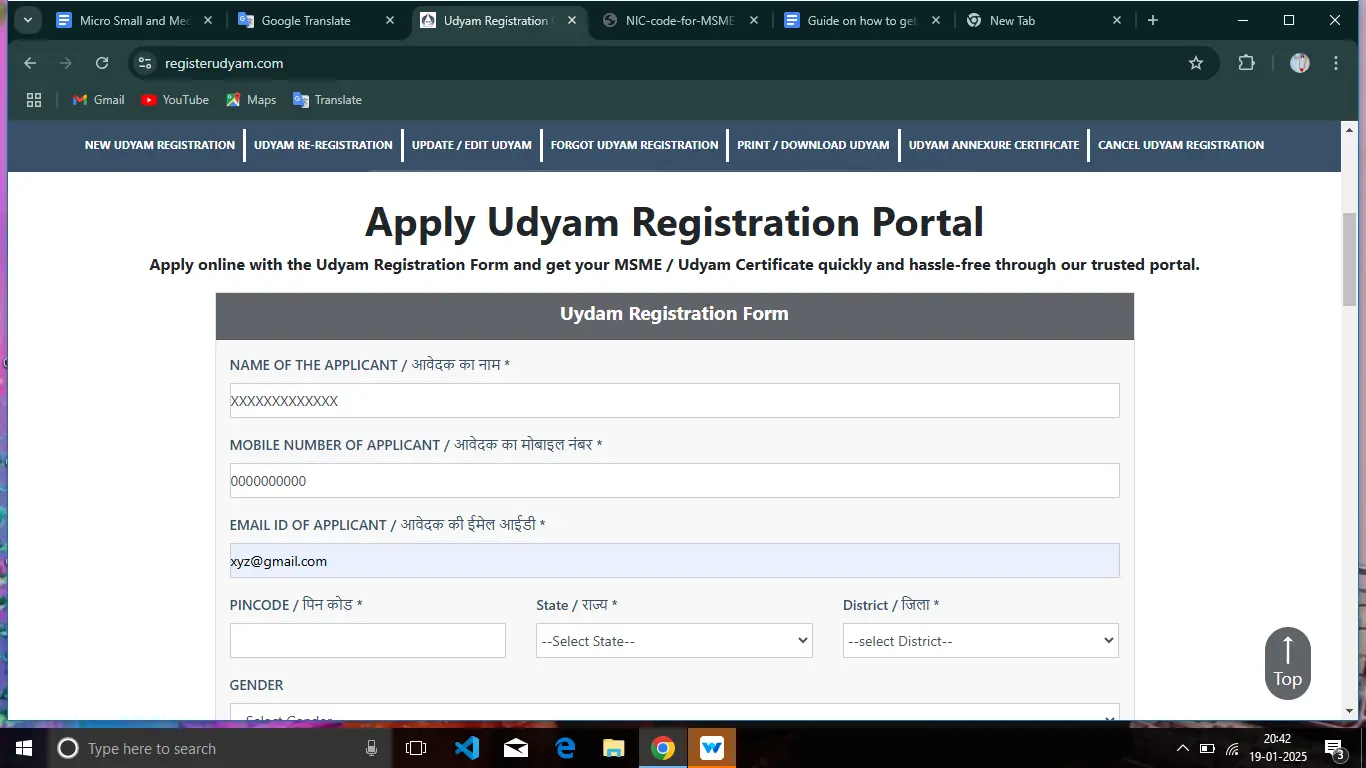

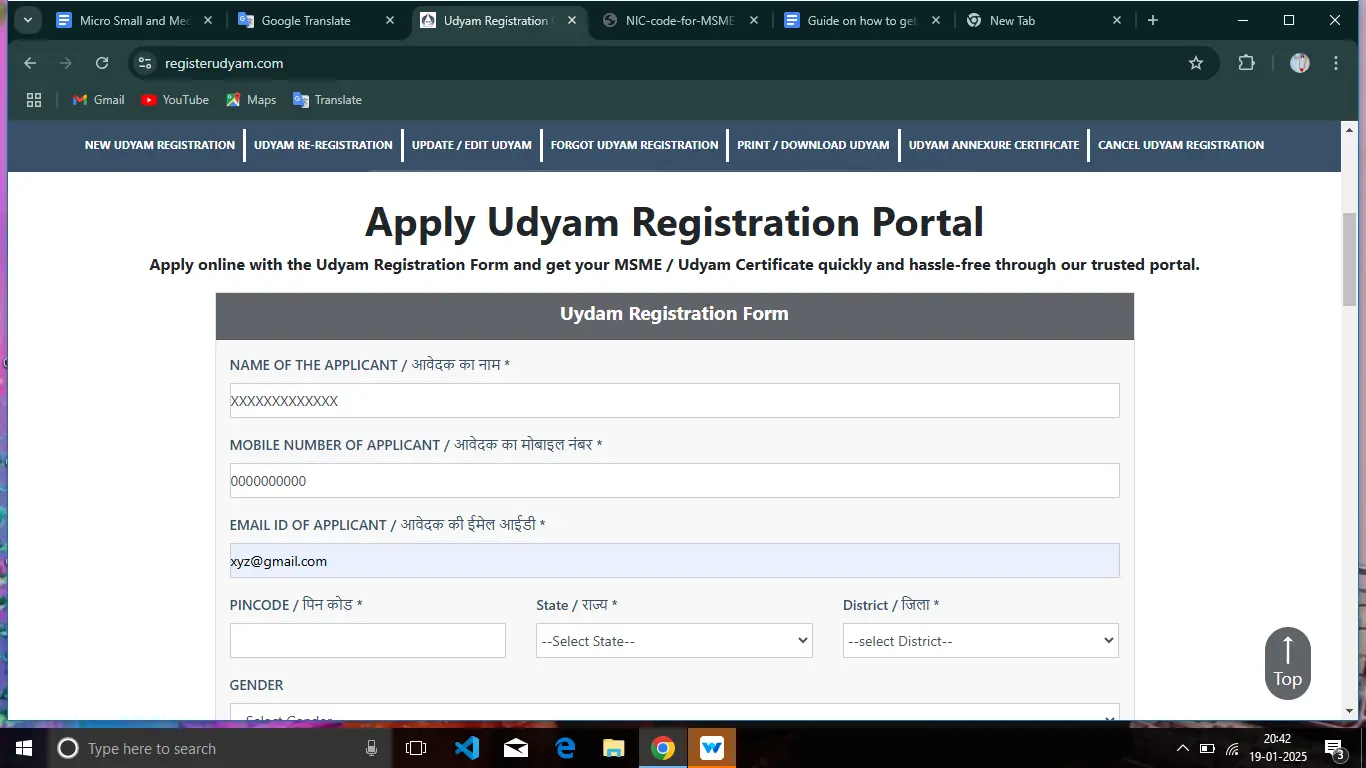

Steps 1: First of all visit our official website registerudyam.com

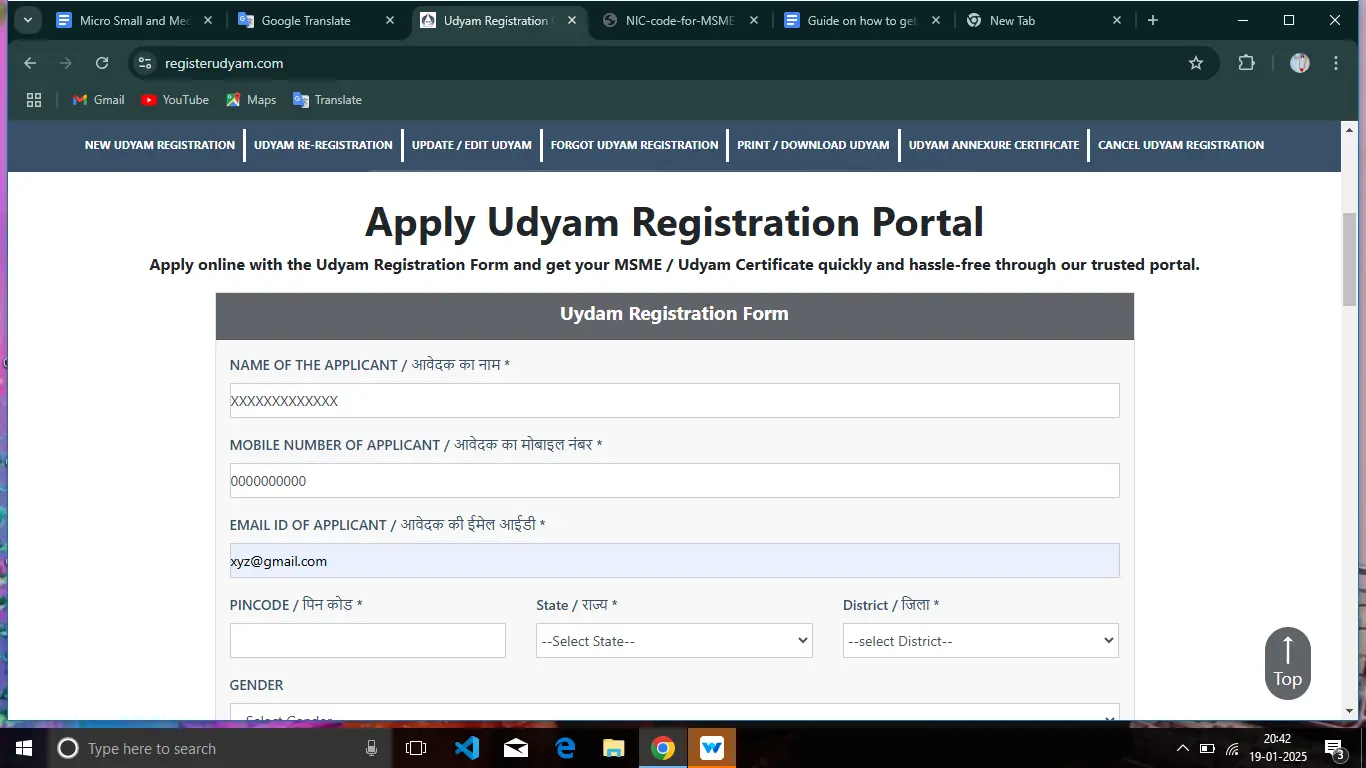

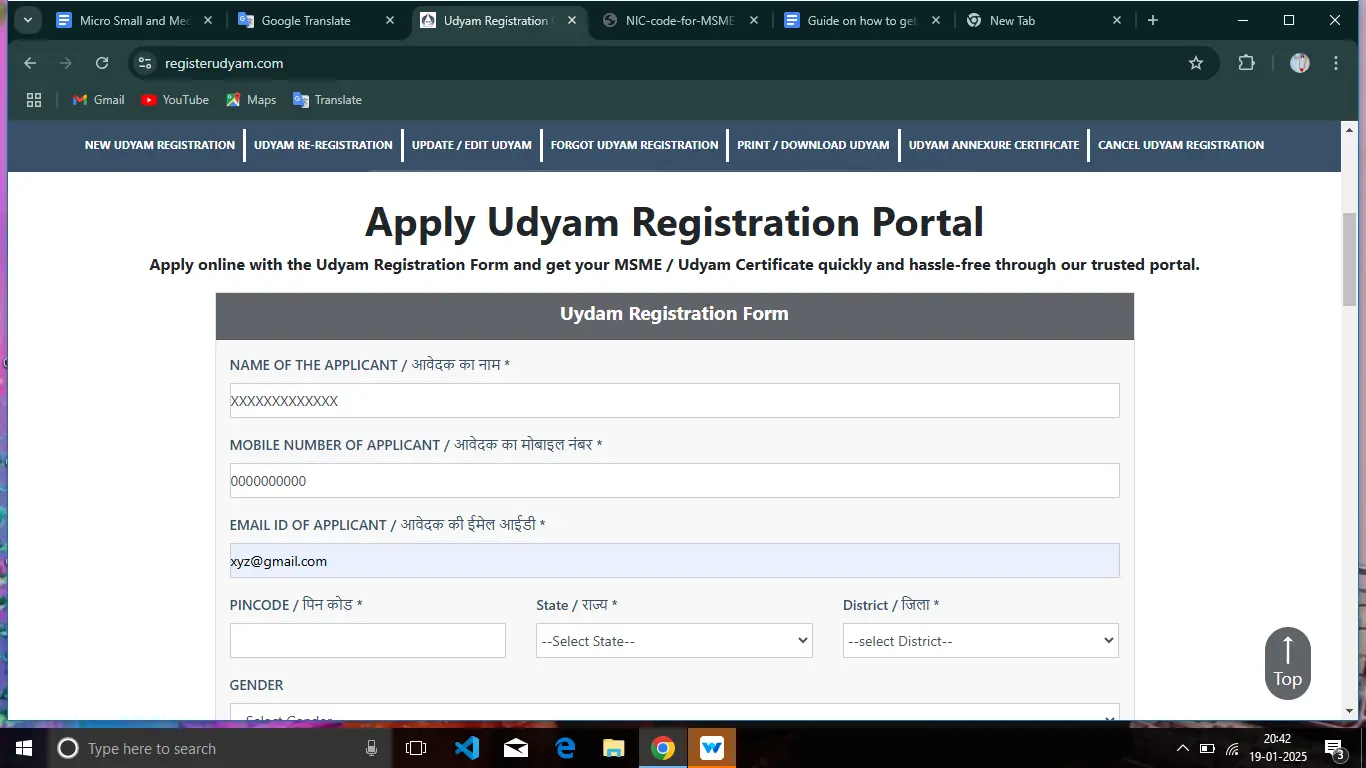

- Steps 2: After that go to New Udyam Registration.

- Steps 3:

There you will find the Udyam Registration Form open.

- Steps 4: Fill out the given Udyam Registration Form correctly.

- Here you will have to give information like the applicant's name, mobile number, email ID PIN code.

- Then you will have to give the name of your state and district, gender, and social category. Fill in all the basic data properly.

- Steps 5:

Fill in the name of your business, the date your business was started, and the address of your business.

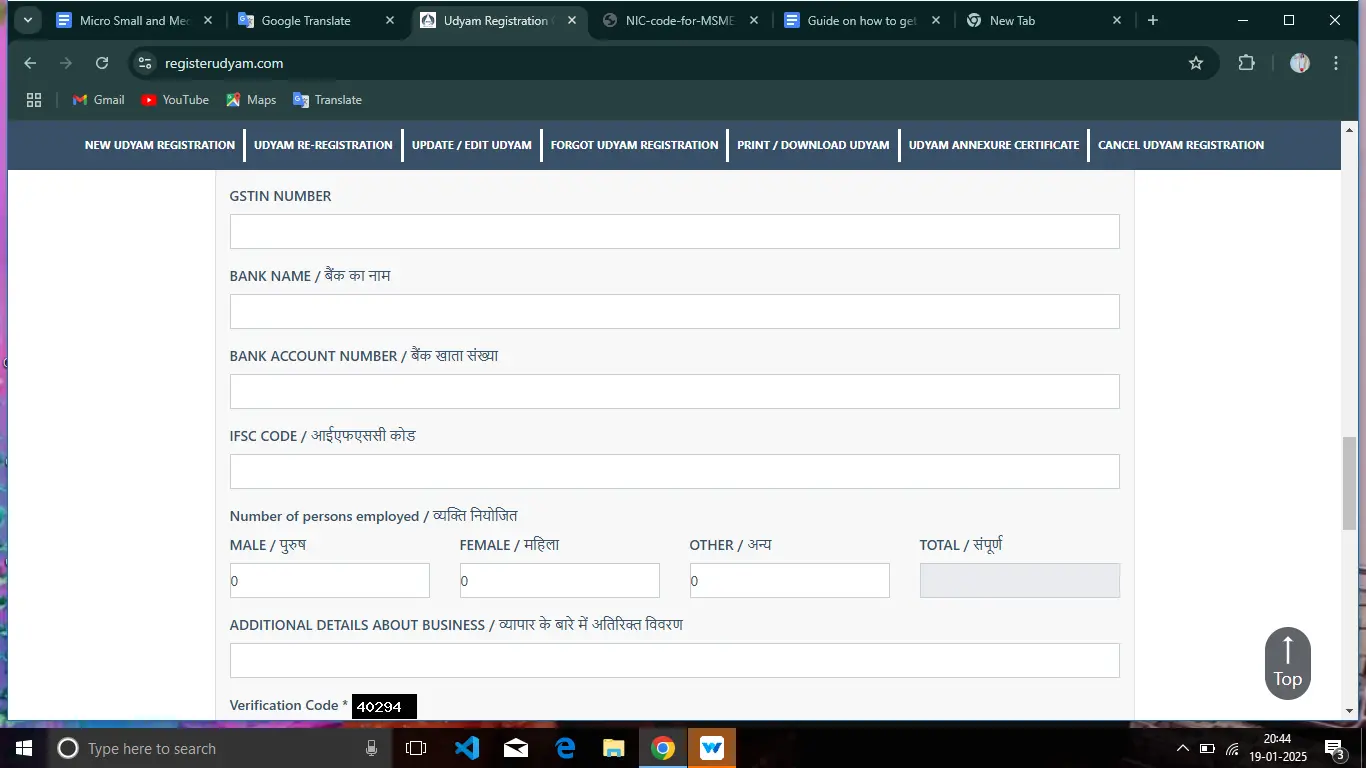

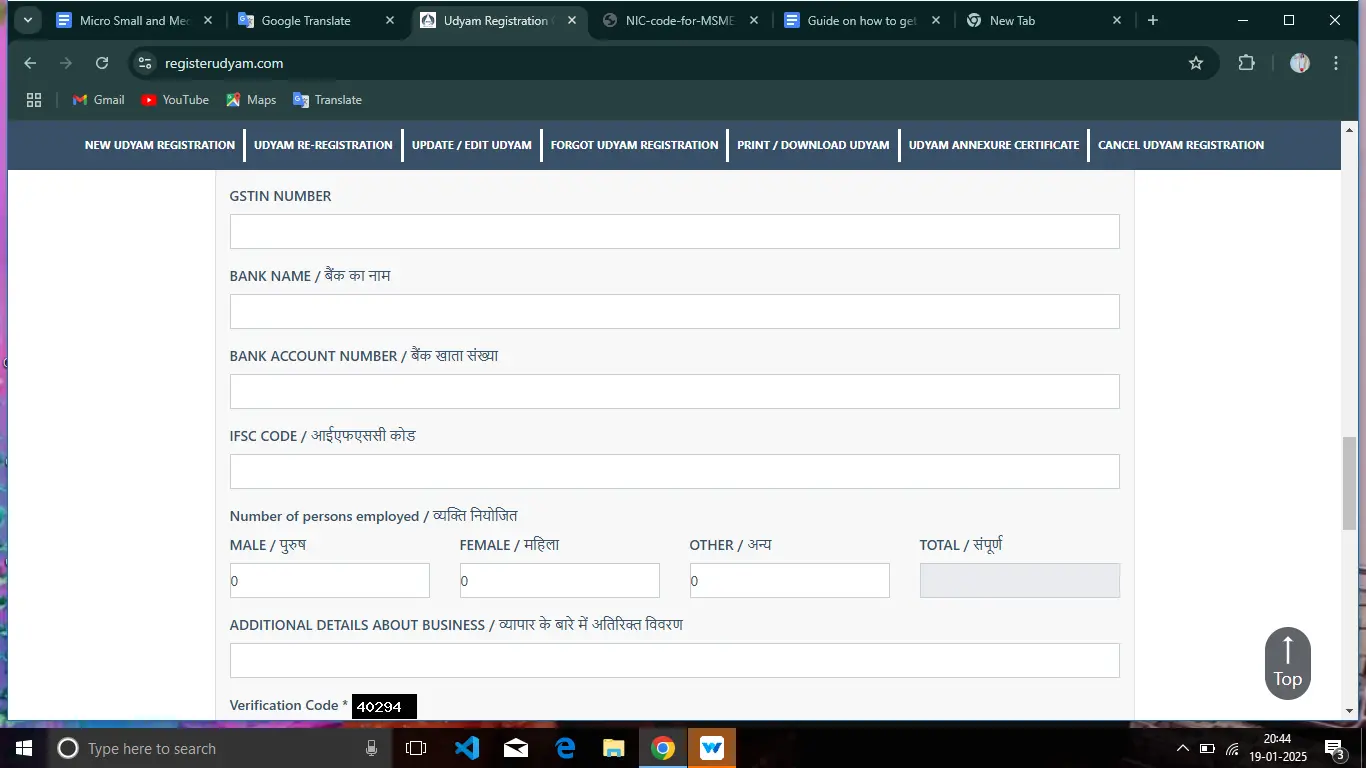

- Steps 6: Choose your organization. What type of organization is yours from the drop-down box and what is the main business activity of your company like whether you are a manufacturer, service provider, or trader. Choose it.

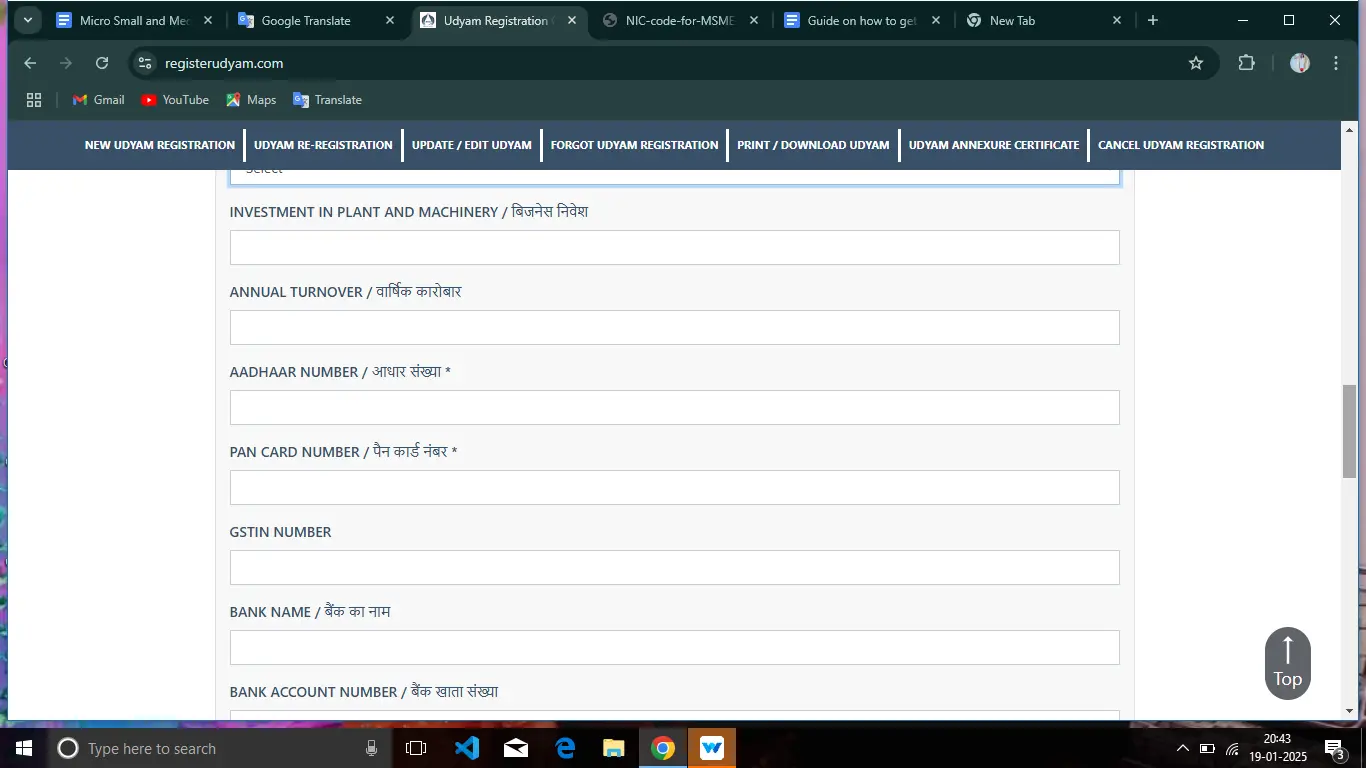

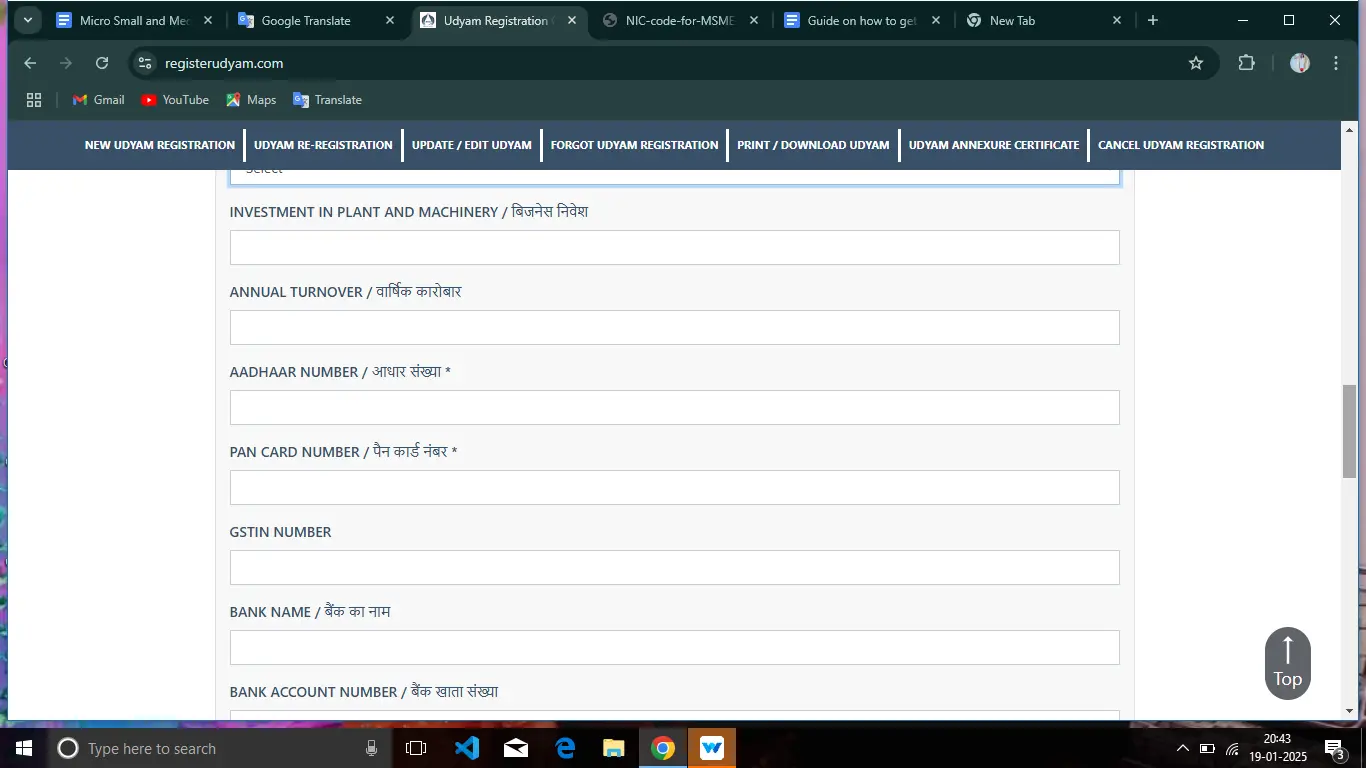

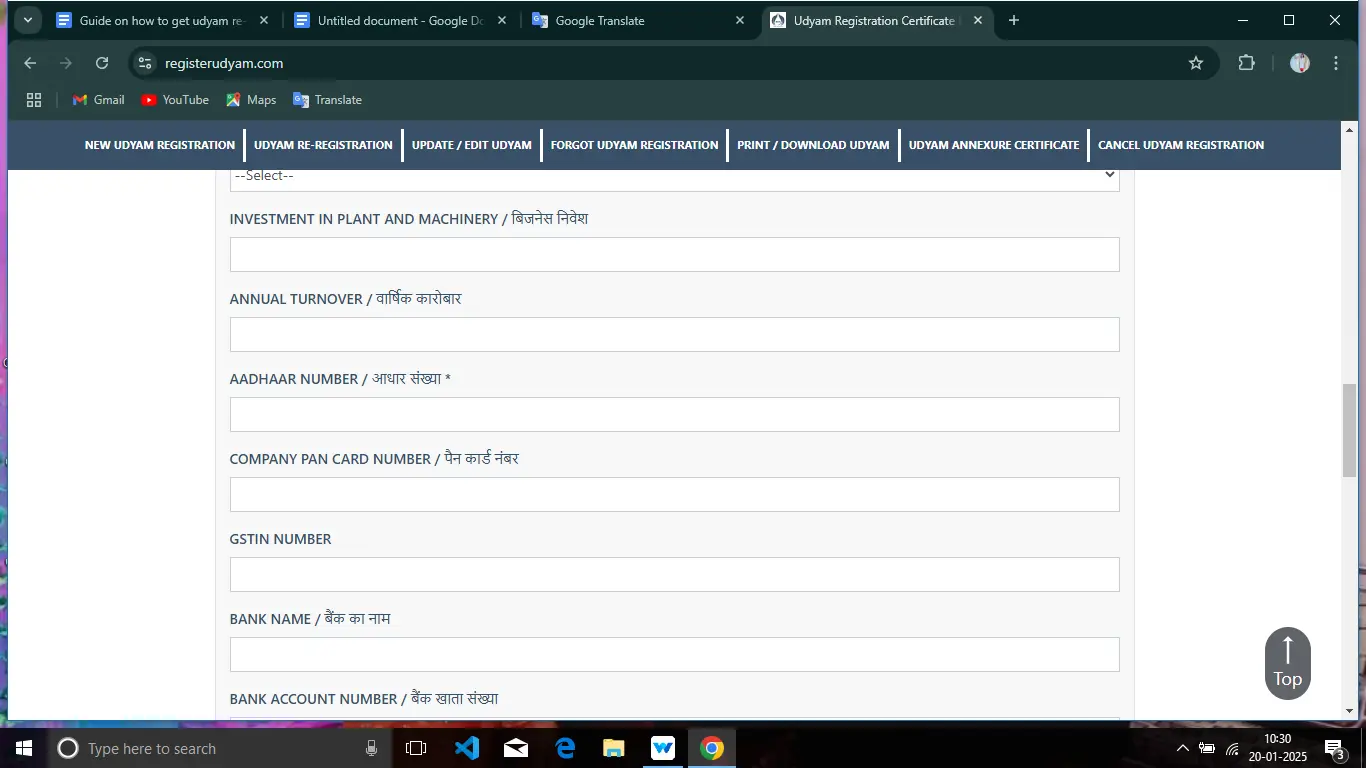

- Steps 7: Fill how much investment you have in your plant machinery and your annual turnover.

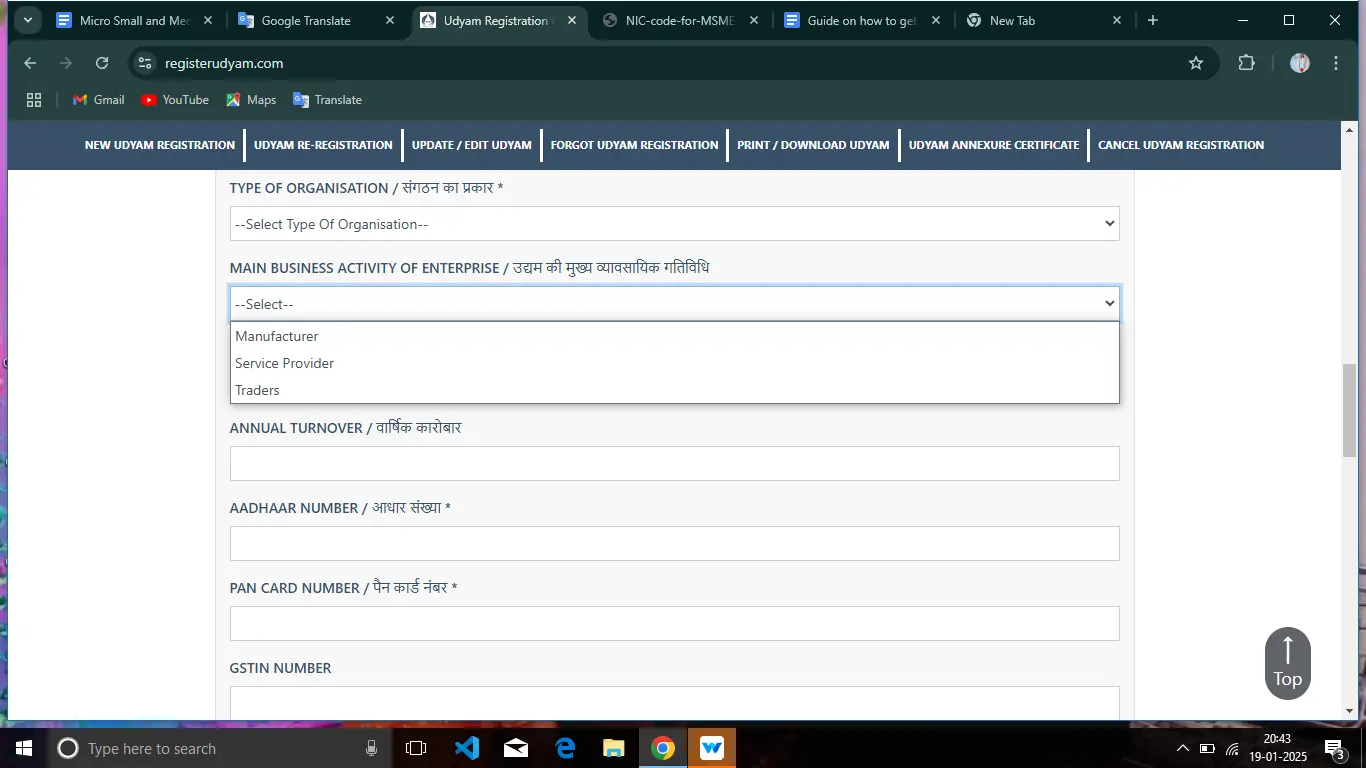

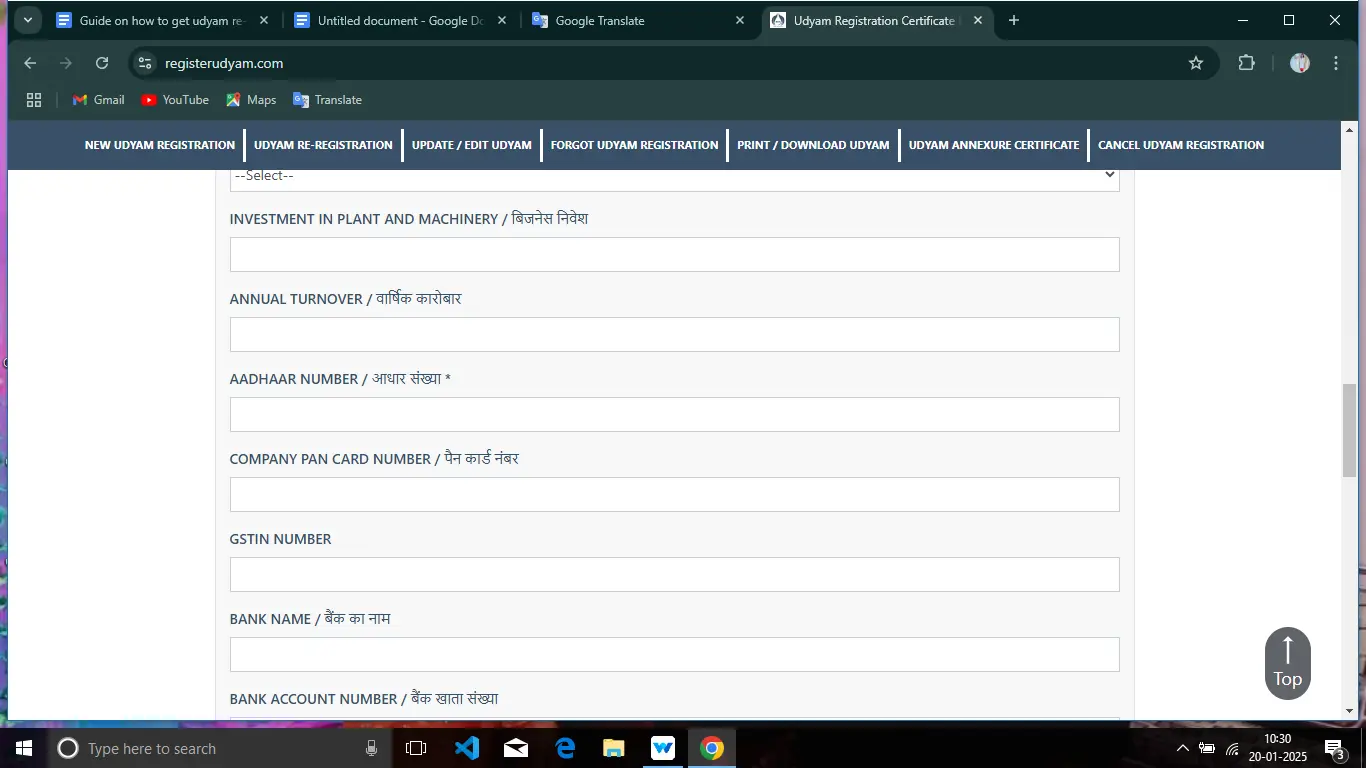

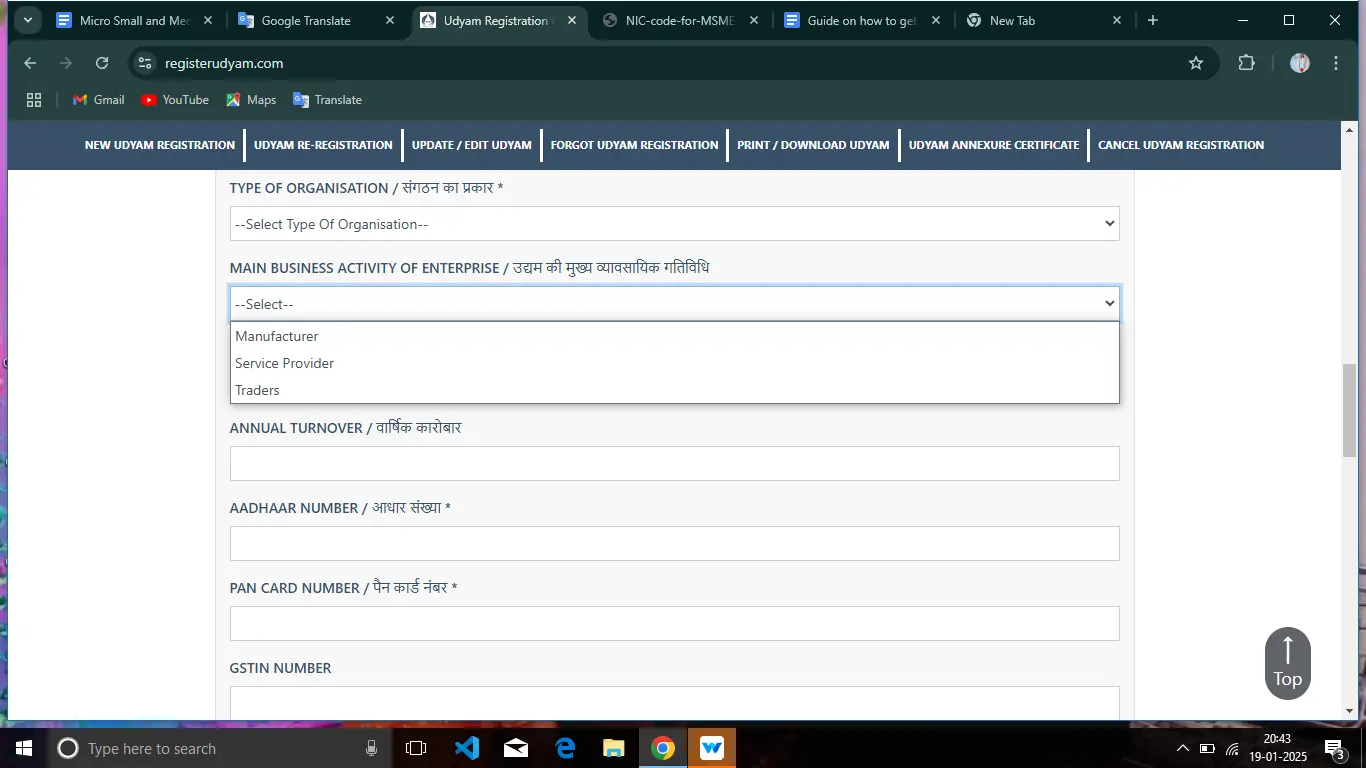

- Steps 8: Fill in your details like Aadhaar number, PAN card number, GSTIN number.

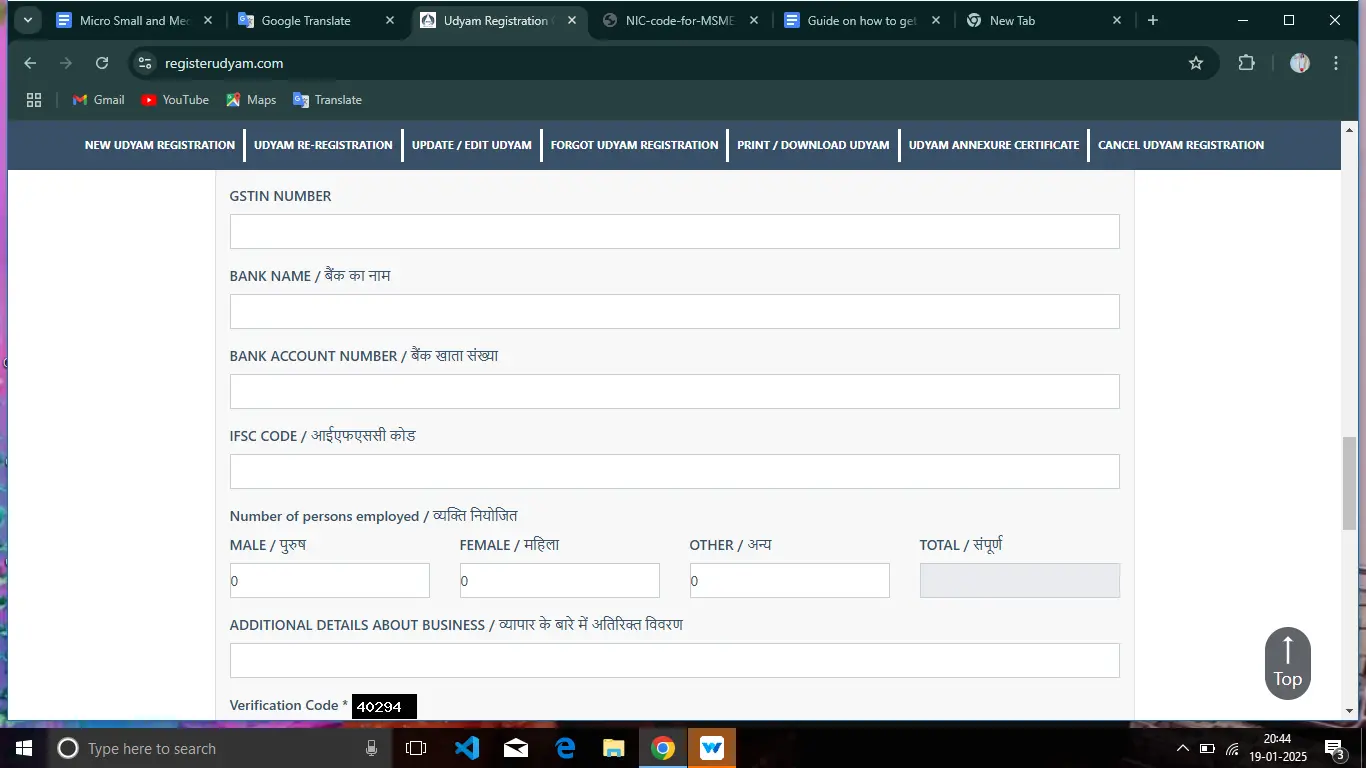

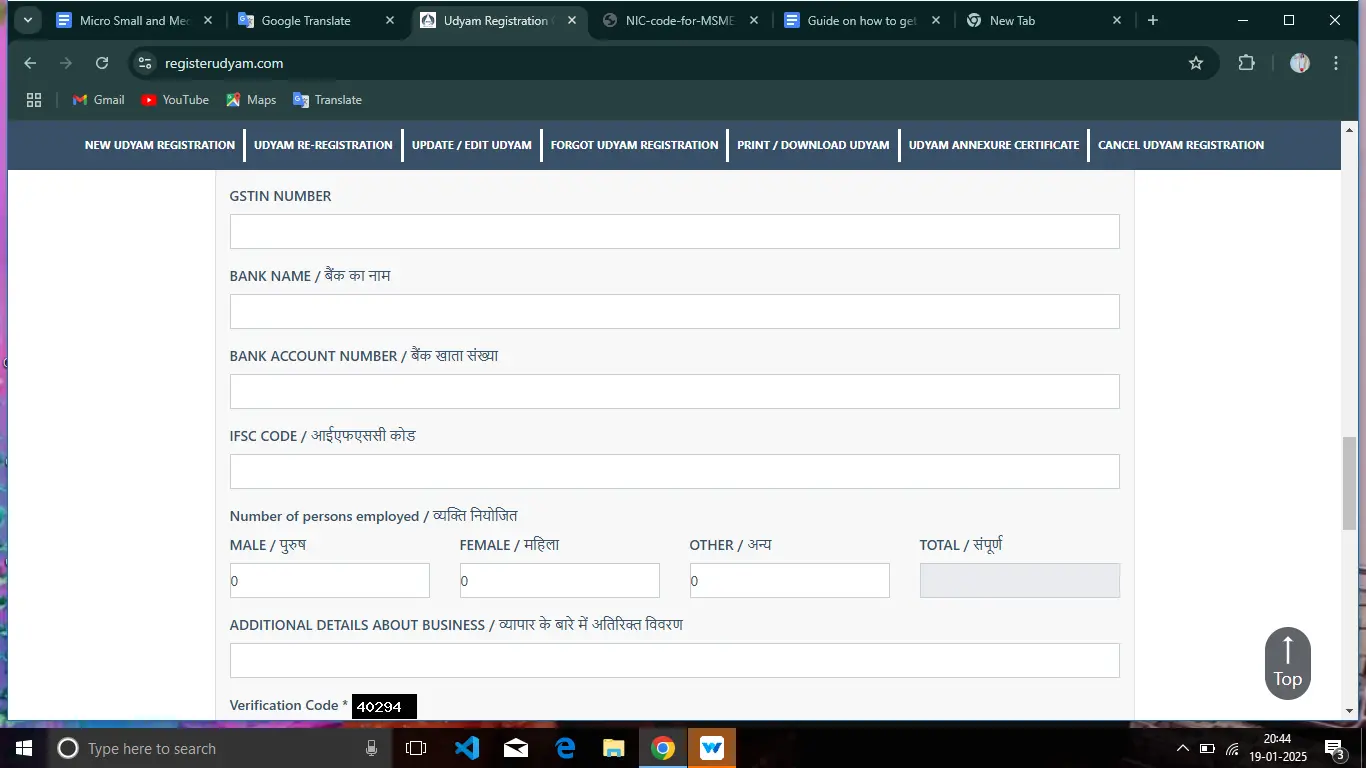

- Steps 9: Give your Bank name, bank account number, and IFSC code. Fill it out correctly.

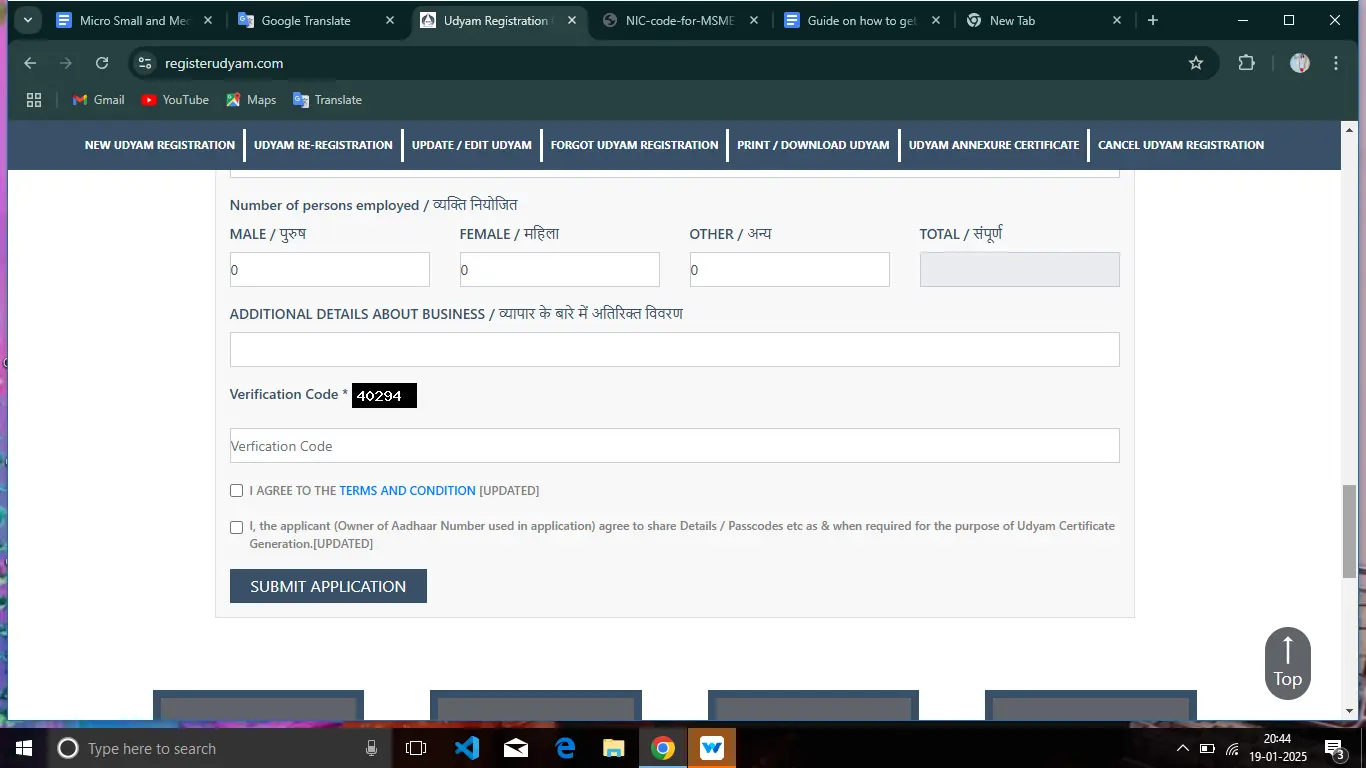

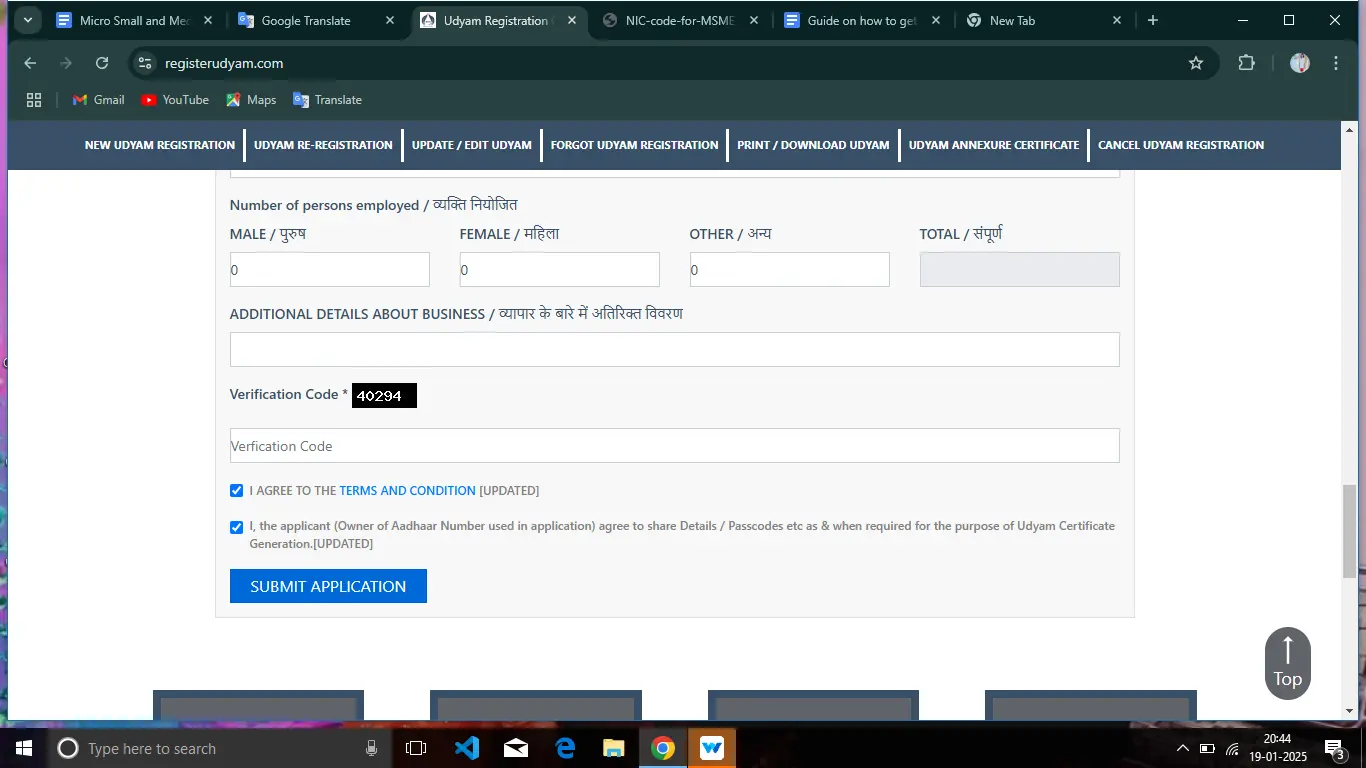

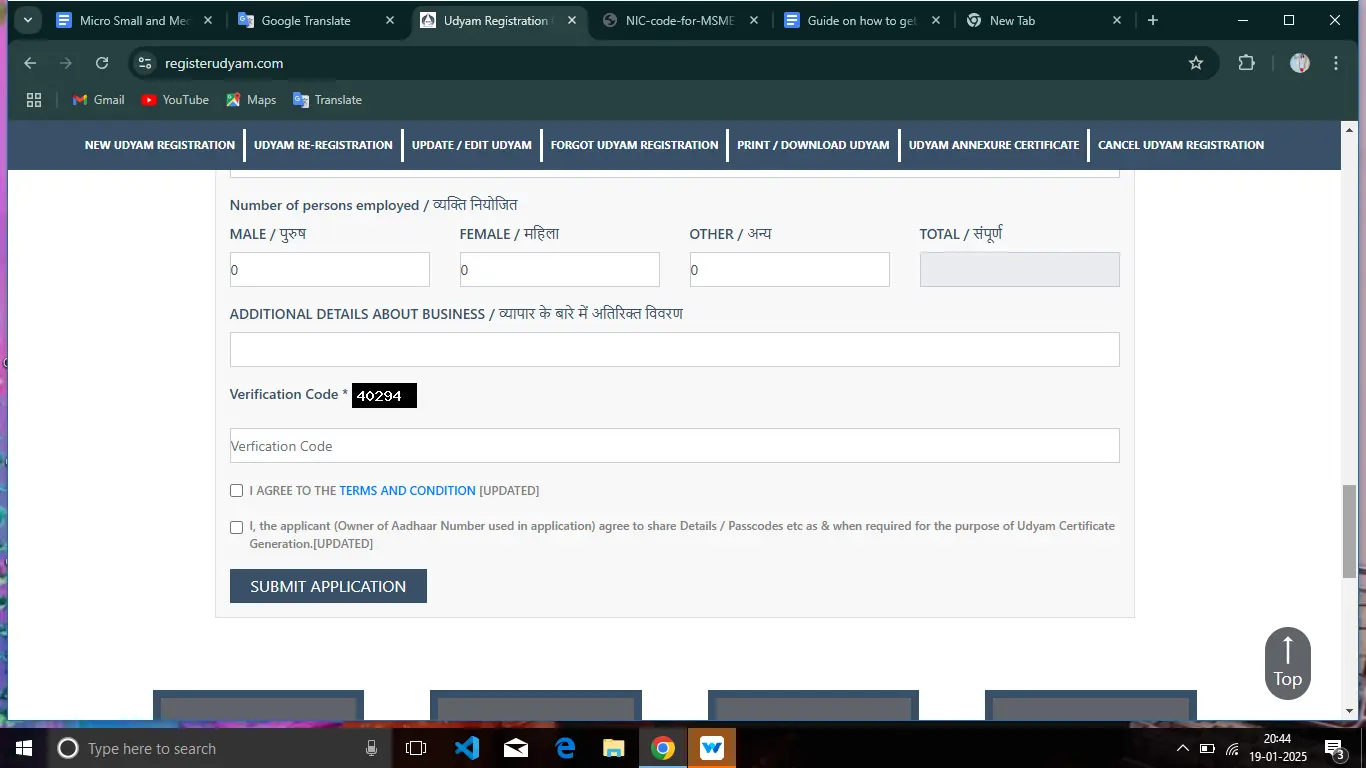

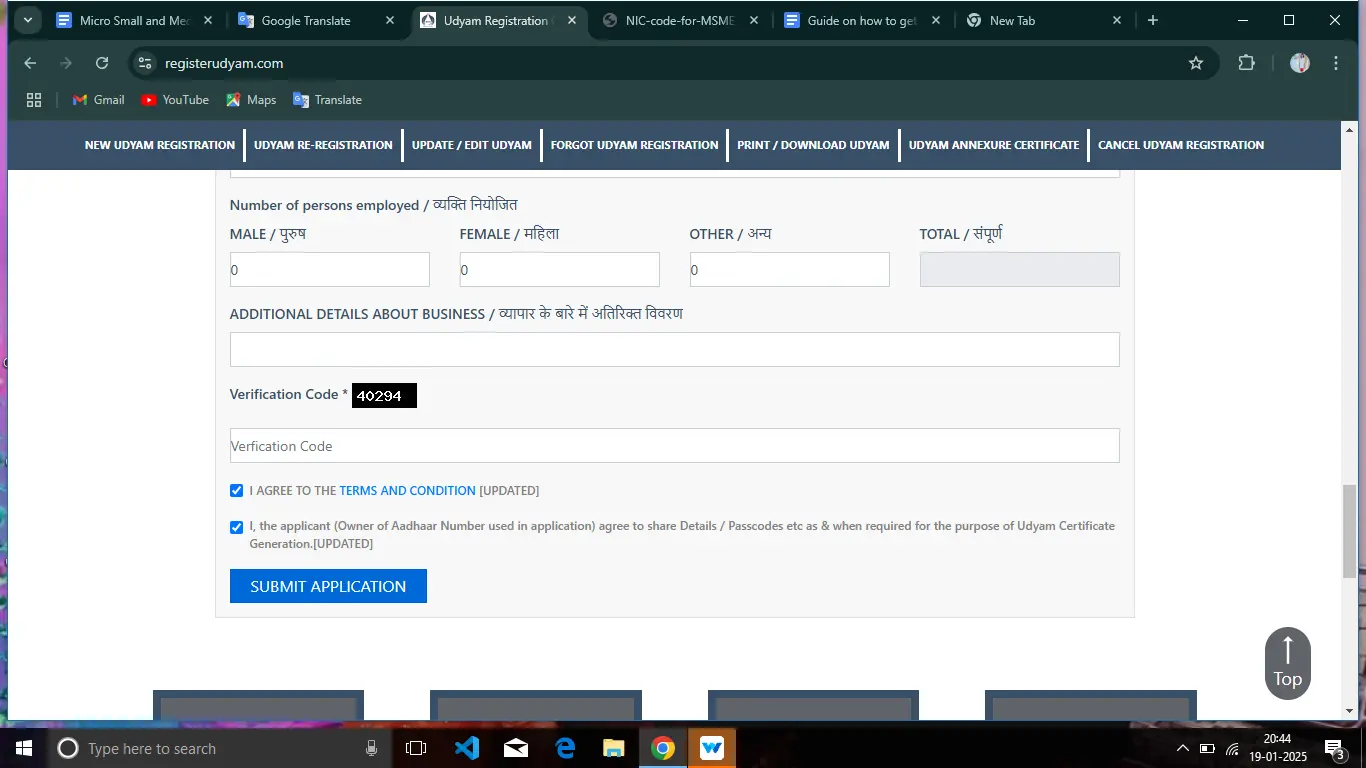

- Steps 10: Then number of people who got employment in your organization. Like how many men and women are there in your organization and others. If you want to give any additional details about your business, you can give that as well.

- Steps 11: Then type the verification code given below, read the terms and conditions carefully, and checkmark it. After this, check the declaration given and submit your application.

You will directly go to the payment gateway. After making the payment, you will get a call for OTP verification and you will receive a confirmation mail.

What are the benefits of getting a Udyam registration certificate?

- It helps in getting government tenders.

- Business loans are available at low interest rates from banks and NBFCs.

- Many tax benefits are available only to Udyam.

- Government permit permission and business registration become easy.

- You will also be given help with capital tax and tariff subsidy.

- If you want to set up your own business, then you will be provided with remission and concessions in it.

Eligibility Criteria for Udyam Registration

Various types of businesses are eligible for Udyam Registration as given below:

- Proprietorship

- Partnership firms

- Hindu undivided Families

- Limited Liability Partnership

- Private Limited Company

- Cooperative Society

- Self Help Group

- Trust

MSMEs are categorized based on investment and turnover limits.

Enterprise Type

| Type |

Investment Requirements |

Criteria for Annual Turnover |

| Micro |

Less than ₹1 crore |

Less than ₹5 crore |

| Small |

Less than ₹10 crore |

Less than ₹50 crores |

| Medium |

Less than ₹50 crores |

Less than ₹250 crores |

Other Requirements

- MSME enterprises involved in manufacturing, production, and service activities.

- Aadhaar card number is mandatory for registration.

- If your organization is a proprietorship, then the Aadhaar card of the owner is required.

- If it is another entity, then the Aadhaar of the managing partner or director is required.

- A PAN card and GST IN number are required for verification and classification.

When should you apply for Udyam or MSME registration?

As soon as your entity starts, you should immediately apply for MSME registration, but Udyam registration depends on the discretion of the entrepreneur. As soon as the entrepreneur registers his organization, he gets many benefits from government schemes.

What documents are required for the Udyam registration process?

If you want to do Udyam registration online, then you will need the following documents:

- Aadhaar Number: Aadhaar number of the business owner.

- PAN Card: 10 alphanumeric digits Permanent Account Number of the business owner.

- GSTIN: If the organization has a Goods and Services Identification Number, then that document is required.

- Business Address Proof: Such as property tax papers, electricity bills, or telephone bill proof.

- Bank Account Details: Such as bank name, bank account number, IFSC code, etc.

- Certificate of Incorporation or Partnership Deed for Companies and Partnerships.

- Shop Act Information or License if running other types of businesses.

- Latest ITR and Financial Statements of an Enterprise: To provide turnover or investment details of the Enterprise.

Note: Aadhaar number documents depend on the type of business like:

- The proprietor firm needs the Aadhaar number of the owner.

- Partnership firm needs the Aadhaar number of the managing partner.

- Hindu Undivided Family needs KARTA Aadhaar number.

- The company, Limited Liability Partnership, Co-operative Society, Society, or Trust needs the Aadhaar number of the authorized signatory.

Note: Every business doesn't need to provide a GST number for Udyam Registration. Only those businesses are required to provide their GST number who have done GST registration of their businesses as per the GST law.

If you have got your MSME Udyam Registration done then you can download and print your Udyam Certificate by clicking on this link.

Conclusion

Udyam registration is a very important step for all the MSMEs in India. With its help, they can get the benefit of many schemes provided by the government like loans, subsidies, and other support. They can gain the trust of their consumers and achieve success. That is why Register Udyam has made an easy process for Udyam registration. If you need any information related to Udyam registration, please visit the website of Register Udyam.